Essay

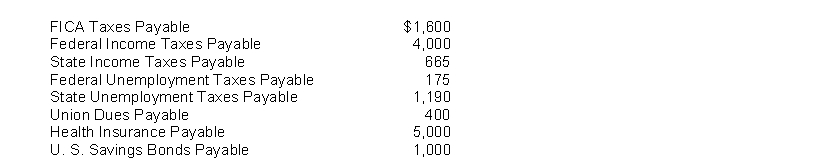

The following payroll liability accounts are included in the ledger of Clementine Company on January 1, 2018:  In January, the following transactions occurred:

In January, the following transactions occurred:

Jan. 9 Sent a check for $5,000 to Blue Cross and Blue Shield.

11 Deposited a check for $5,600 in Federal Reserve Bank for FICA taxes and federal income taxes withheld.

14 Sent a check for $400 to the union treasurer for union dues.

18 Paid state income taxes withheld from employees.

21 Paid state and federal unemployment taxes.

22 Purchased U. S. Savings Bonds for employees by writing a check for $1,000.

Instructions

Journalize the January transactions

Correct Answer:

Verified

Correct Answer:

Verified

Q5: Which of the following employees would likely

Q15: A Wage and Tax Statement shows gross

Q17: Diane Lane earns a salary of $9,900

Q19: Lucie Ball's regular rate of pay is

Q21: Instructions<br>Compute Banner's payroll tax expense for the

Q24: An employee earnings record is a cumulative

Q25: Match the codes assigned to the following

Q136: The journal entry to record the payroll

Q147: FICA taxes withheld and federal income taxes

Q167: Two federal taxes which are levied against