Short Answer

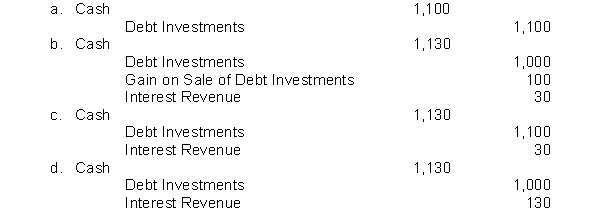

On January 1, Vega Company purchased as an investment a $1,000, 6% bond for $1,000. The bond pays interest on January 1. The bond is sold on July 1 for $1,100 plus accrued interest. Interest has not been accrued since the last interest payment date. What is the entry to record the cash proceeds at the time the bond is sold?

Correct Answer:

Verified

Correct Answer:

Verified

Q85: At the time of acquisition of a

Q86: On January 1, U.K. Enterprise purchased as

Q87: If a stock investment is sold at

Q88: If the cost method is used to

Q89: On January 1, 2017, the Express Corporation

Q91: The receipt of dividends on an investment

Q92: On January 1, Bay View Company purchased

Q93: On January 1, 2017, JBT Company purchased

Q94: An unrealized loss on trading securities is

Q95: On January 1, Belvedere Company purchased as