Multiple Choice

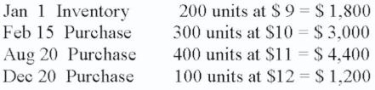

Moss Co. uses the FIFO method to calculate ending inventory. Assuming 300 units are not sold, the cost of goods sold is:

A) $7,600

B) $7,280

C) $3,120

D) $3,400

E) None of these

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q6: Given the following information, you have been

Q10: Stone Company uses the LIFO method. At

Q12: Calculate inventory turnover at cost (to nearest

Q14: Calculate estimated cost of ending inventory using

Q15: Bob's Clothing Shop's inventory at cost was

Q15: Ron Co. has a gross profit on

Q16: Belle Co. has beginning inventory of 12

Q43: Crestwood Paint Supply had a beginning inventory

Q93: The gross profit method is a way

Q98: Inventory turnover at retail is equal to