Multiple Choice

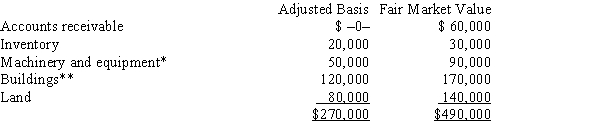

Mr. and Ms. Smith's partnership owns the following assets:  * Potential § 1245 recapture of $45,000.

* Potential § 1245 recapture of $45,000.

** Straight-line depreciation was used.

Mr) and Ms. Smith each have a basis for their partnership interest of $135,000. Calculate their combined recognized gain or loss and classify it as capital or ordinary if they sell their partnership interests for $500,000.

A) $230,000 ordinary income.

B) $230,000 capital gain.

C) $115,000 ordinary income and $115,000 capital gain.

D) $110,000 ordinary income and $120,000 capital gain.

E) None of the above.

Correct Answer:

Verified

Correct Answer:

Verified

Q11: An S corporation election for Federal income

Q24: Techniques that can be used to minimize

Q28: Match the following statements.<br>-Net capital loss<br>A)For the

Q33: Actual dividends paid to shareholders result in

Q39: John wants to buy a business whose

Q56: Match the following statements.<br>-Technique for minimizing double

Q69: A limited liability company LLC) is a

Q85: If lease rental payments to a noncorporate

Q85: If an individual contributes an appreciated personal

Q95: Daniel, who is single, estimates that the