Multiple Choice

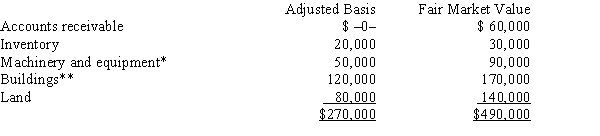

Kristine owns all of the stock of a C corporation which owns the following assets:  * Potential § 1245 recapture of $45,000.

* Potential § 1245 recapture of $45,000.

** Straight-line depreciation was used.

Her adjusted basis for her stock is $270,000. Calculate Kristine's recognized gain or loss and classify it as capital or ordinary if she sells her stock for $500,000.

A) $230,000 ordinary income.

B) $230,000 capital gain.

C) $115,000 ordinary income and $115,000 capital gain.

D) $110,000 ordinary income and $120,000 capital gain.

E) None of the above.

Correct Answer:

Verified

Correct Answer:

Verified

Q11: An S corporation is not subject to

Q62: Match the following statements:<br>-Alternative minimum tax<br>A)For the

Q68: What special adjustment is required in calculating

Q76: Why does stock redemption treatment for an

Q77: Which of the following are "reasonable needs"

Q80: Match the following attributes with the different

Q92: All of the shareholders of an S

Q100: Match each of the following statements with

Q107: The special allocation opportunities that are available

Q126: Khalid contributes land (fair market value of