Multiple Choice

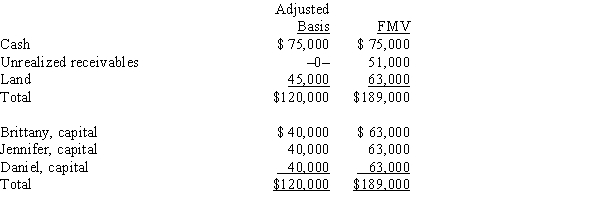

Brittany, Jennifer, and Daniel are equal partners in the BJD Partnership. The partnership balance sheet reads as follows on December 31 of the current year.  Partner Daniel has an adjusted basis of $40,000 for his partnership interest. If Daniel sells his entire partnership interest to new partner Amber for $73,000 cash, how much can the partnership step-up the basis of Amber's share of partnership assets under §§ 754 and 743(b) ?

Partner Daniel has an adjusted basis of $40,000 for his partnership interest. If Daniel sells his entire partnership interest to new partner Amber for $73,000 cash, how much can the partnership step-up the basis of Amber's share of partnership assets under §§ 754 and 743(b) ?

A) $6,000

B) $17,000

C) $23,000

D) $33,000

E) None of the above

Correct Answer:

Verified

Correct Answer:

Verified

Q27: Generally, no gain is recognized on a

Q37: Nicky's basis in her partnership interest was

Q64: Alyce owns a 30% interest in a

Q67: Which of the following statements correctly reflects

Q85: The JIH Partnership distributed the following assets

Q100: Mark contributed property to the MDB Partnership

Q110: Nick sells his 25% interest in the

Q117: Loss cannot be recognized on a distribution

Q122: Generally, a distribution of property does not

Q127: Match the following statements with the best