Multiple Choice

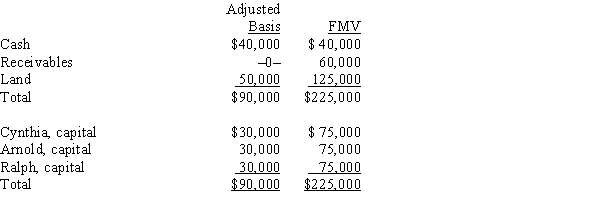

Cynthia sells her 1/3 interest in the CAR Partnership to Brandon for $95,000 cash. On the date of sale, the partnership balance sheet and agreed-upon fair market values were as follows:  If the partnership has a § 754 election in effect, the total "step-up" in basis of partnership assets that will be allocated to Brandon is:

If the partnership has a § 754 election in effect, the total "step-up" in basis of partnership assets that will be allocated to Brandon is:

A) $75,000.

B) $65,000.

C) $45,000.

D) $20,000.

E) $0.

Correct Answer:

Verified

Correct Answer:

Verified

Q7: Zach's partnership interest basis is $100,000. Zach

Q44: George is planning to retire from the

Q58: Randi owns a 40% interest in the

Q92: Mark receives a proportionate nonliquidating distribution.At the

Q94: Megan's basis was $120,000 in the MYP

Q104: Mack has a basis in a partnership

Q116: George (a calendar year taxpayer) owns a

Q132: Match the following statements with the best

Q152: Dan receives a proportionate nonliquidating distribution when

Q248: Tim and Darby are equal partners in