Essay

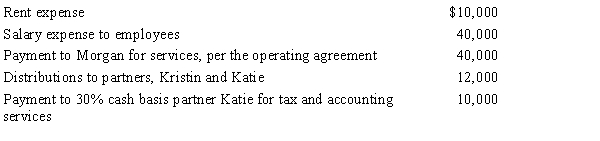

Morgan is a 50% managing member in the calendar year, cash basis MKK LLC. The LLC received $150,000 income from services and paid the following other amounts:

How much will Morgan's adjusted gross income increase as a result of the above items? What amount will be included in Morgan's self-employment tax calculation?

Correct Answer:

Verified

$65,000 income and amount included in SE...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q14: Carli contributes land to the newly formed

Q46: If a partnership allocates losses to the

Q54: A partnership cannot use the cash method

Q54: Which of the following statements is correct

Q109: Match each of the following statements with

Q138: Match each of the following statements with

Q140: Match each of the following statements with

Q173: Blaine contributes property valued at $50,000 (basis

Q174: The taxable income of a partnership flows

Q180: Ashley purchased her partnership interest from Lindsey