Multiple Choice

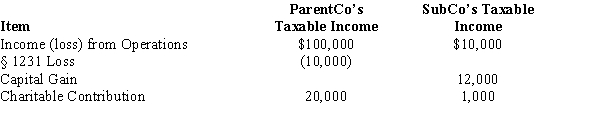

ParentCo and SubCo had the following items of income and deduction for the current year.  Compute ParentCo and SubCo's consolidated taxable income or loss.

Compute ParentCo and SubCo's consolidated taxable income or loss.

A) $91,000

B) $100,800

C) $112,000

D) $122,000

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q12: Match each of the following items with

Q33: Match each of the following terms with

Q64: When a subsidiary sells to the parent

Q71: JuniorCo sells an asset to SeniorCo at

Q72: In computing consolidated E & P, dividends

Q88: The calendar year Sterling Group files its

Q97: A limited partnership can join the parent's

Q114: Most of the rules governing the use

Q119: Match each of the following items with

Q144: ParentCo owned 100% of SubCo for the