Multiple Choice

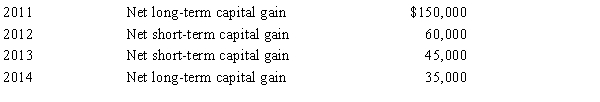

Carrot Corporation, a C corporation, has a net short-term capital gain of $65,000 and a net long-term capital loss of $250,000 during 2015. Carrot Corporation had taxable income from other sources of $720,000. Prior years' transactions included the following:  Compute the amount of Carrot's capital loss carryover to 2016.

Compute the amount of Carrot's capital loss carryover to 2016.

A) $0

B) $32,000

C) $45,000

D) $185,000

E) None of the above

Correct Answer:

Verified

Correct Answer:

Verified

Q6: The passive loss rules apply to closely

Q9: Crow Corporation, a C corporation, donated scientific

Q18: A personal service corporation must use a

Q21: Double taxation of corporate income results because

Q23: During the current year, Violet, Inc., a

Q55: Eagle Company, a partnership, had a short-term

Q76: Robin Corporation,a calendar year C corporation,had taxable

Q81: Norma formed Hyacinth Enterprises, a proprietorship, in

Q82: Lucinda is a 60% shareholder in Rhea

Q107: In the current year,Crimson,Inc.,a calendar C corporation,has