Multiple Choice

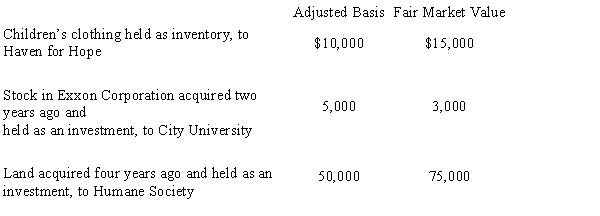

During the current year, Owl Corporation (a C corporation) , a retailer of children's apparel, made the following donations to qualified charitable organizations.  How much qualifies for the charitable contribution deduction (ignoring the taxable income limitation) ?

How much qualifies for the charitable contribution deduction (ignoring the taxable income limitation) ?

A) $63,000

B) $65,000

C) $90,500

D) $92,500

E) None of the above

Correct Answer:

Verified

Correct Answer:

Verified

Q5: If a C corporation uses straight-line depreciation

Q7: Lilac Corporation incurred $4,700 of legal and

Q11: Donald owns a 45% interest in a

Q13: Employment taxes apply to all entity forms

Q27: Briefly describe the accounting methods available for

Q37: A corporate net operating loss can be

Q53: Tomas owns a sole proprietorship, and Lucy

Q58: What is the annual required estimated tax

Q69: In the current year, Sunset Corporation (a

Q91: Nancy is a 40% shareholder and president