Multiple Choice

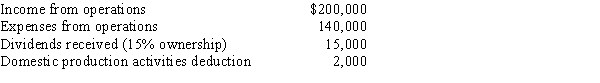

During the current year, Kingbird Corporation (a calendar year C corporation) had the following income and expenses:  On October 1, Kingbird Corporation made a contribution to a qualified charitable organization of $9,000 in cash (not included in any of the above items) . Determine Kingbird's charitable contribution deduction for the current year.

On October 1, Kingbird Corporation made a contribution to a qualified charitable organization of $9,000 in cash (not included in any of the above items) . Determine Kingbird's charitable contribution deduction for the current year.

A) $9,000

B) $7,500

C) $6,650

D) $6,450

E) None of the above

Correct Answer:

Verified

Correct Answer:

Verified

Q18: Under the check-the-box Regulations, a two-owner LLC

Q21: A corporation with $5 million or more

Q25: For purposes of the estimated tax payment

Q27: Heron Corporation,a calendar year C corporation,had an

Q56: Dawn is the sole shareholder of Thrush

Q58: Beige Corporation,a C corporation,purchases a warehouse on

Q64: During the current year, Woodchuck, Inc., a

Q64: Azure Corporation, a C corporation, had a

Q79: No dividends received deduction is allowed unless

Q98: Copper Corporation owns stock in Bronze Corporation