Multiple Choice

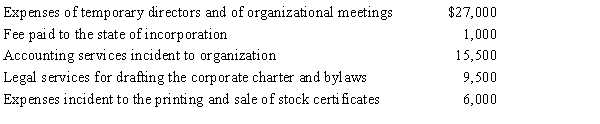

Emerald Corporation, a calendar year C corporation, was formed and began operations on April 1, 2015. The following expenses were incurred during the first tax year (April 1 through December 31, 2015) of operations.  Assuming a § 248 election, what is the Emerald's deduction for organizational expenditures for 2015?

Assuming a § 248 election, what is the Emerald's deduction for organizational expenditures for 2015?

A) $0

B) $4,550

C) $5,000

D) $7,400

E) None of the above

Correct Answer:

Verified

Correct Answer:

Verified

Q7: Pink,Inc.,a calendar year C corporation,manufactures golf gloves.For

Q7: Lilac Corporation incurred $4,700 of legal and

Q11: Donald owns a 45% interest in a

Q27: Briefly describe the accounting methods available for

Q32: Grackle Corporation, a personal service corporation, had

Q33: Flycatcher Corporation,a C corporation,has two equal individual

Q53: Tomas owns a sole proprietorship, and Lucy

Q63: In the current year, Plum Corporation, a

Q69: In the current year, Sunset Corporation (a

Q96: During the current year, Sparrow Corporation, a