Essay

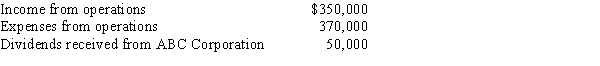

During the current year, Quartz Corporation (a calendar year C corporation) has the following transactions:

Quartz owns 25% of ABC Corporation's stock. How much is Quartz Corporation's taxable income (loss) for the year?

Correct Answer:

Verified

Quartz has an NOL, computed as...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q20: An expense that is deducted in computing

Q30: Which of the following statements is incorrect

Q33: Flycatcher Corporation,a C corporation,has two equal individual

Q42: Patrick, an attorney, is the sole shareholder

Q54: Schedule M-1 of Form 1120 is used

Q56: Ivory Corporation,a calendar year,accrual method C corporation,has

Q60: As a general rule,C corporations must use

Q68: A corporation must file a Federal income

Q80: What is the purpose of Schedule M-3?

Q110: Schedule M-2 is used to reconcile unappropriated