Multiple Choice

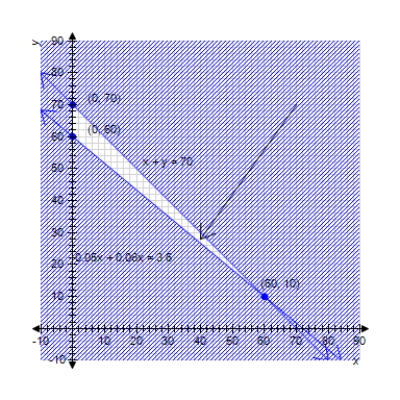

The Pimco New York Municipal Bond Fund (PNF) and the Fidelity Spartan Mass Fund (FDMMX) are tax-exempt municipal bond funds. In 2003, the Pimco fund yielded 6% while the Fidelity fund yielded 5%. You would like to invest a total of up to $70,000 and earn at least $3,600 in interest in the coming year (based on the given yields) . Draw the feasible region that shows how much money you can invest in each fund. Find the corner points of the region.

Let x be the invested sum into FDMMX in thousand dollars, and y be the invested sum into PNF in thousand dollars.

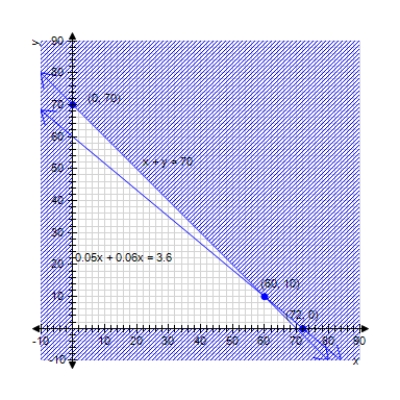

A)

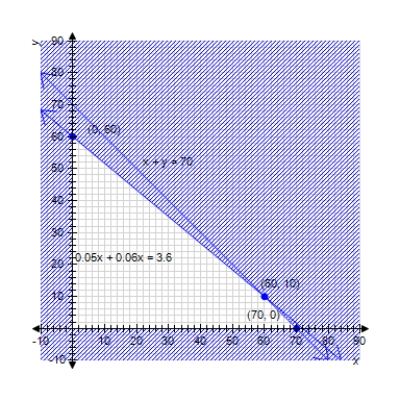

B)

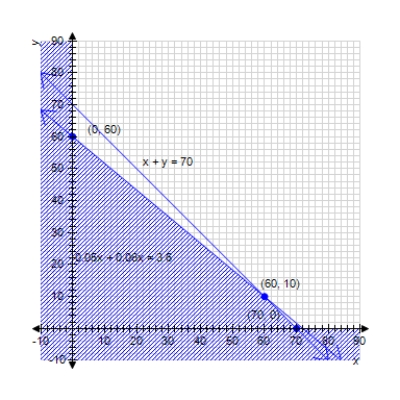

C)

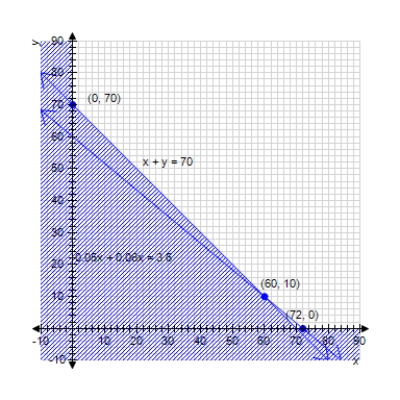

D)

E)

Correct Answer:

Verified

Correct Answer:

Verified

Q35: Ruff, Inc. makes dog food out of

Q36: Fancy Pineapple produces pineapple juice and canned

Q37: You are thinking of combining Cell-Tech

Q38: Minimize <span class="ql-formula"

Q39: Safety-Kleen operates the world's largest oil refinery

Q41: Select the correct graph of the

Q42: Maximize <span class="ql-formula" data-value="p =

Q43: Federal Rent-a-Car is putting together a new

Q44: Your small farm encompasses 100 acres, and

Q45: The Megabuck Hospital Corp. is to build