Multiple Choice

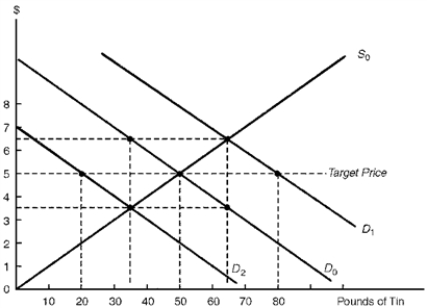

The diagram below illustrates the international tin market. Assume that producing and consuming countries establish an international commodity agreement under which the target price of tin is $5 per pound.

Figure 7.1. Defending the Target Price in Face of Changing Demand Conditions

?

-Consider Figure 7.1.Suppose the demand for tin decreases from D0 to D2.Under a buffer stock system, the buffer-stock manager could maintain the target price by

A) selling 15 pounds of tin.

B) selling 30 pounds of tin.

C) buying 15 pounds of tin.

D) buying 30 pounds of tin.

Correct Answer:

Verified

Correct Answer:

Verified

Q96: To help developing nations strengthen their international

Q97: Import substitution policy tends to be anti-trade,

Q98: In recent decades, the East Asian "newly

Q99: The so-called Four Tigers include Australia, South

Q100: Describe the flying-geese pattern of economic growth.What

Q102: Of the manufactured goods exported by developing

Q103: For Saudi Arabia, oil exports constitute about

Q104: Hong Kong and South Korea are examples

Q105: International commodity agreements do NOT<br>A) consist of

Q106: The characteristics that have underlaid the economic