Multiple Choice

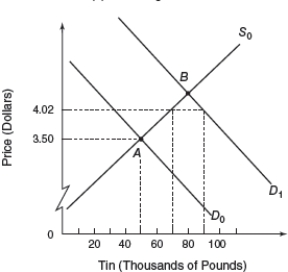

Figure 7.4 Global Market for Tin

-Consider the global market for tin represented by Figure 7.4.Initially equilibrium is at point A with a market price of $3.50 per pound and 50,000 pounds.In order to keep tin price relatively stable, an International Tin Agreement has set a price floor of $3.27 and a ceiling of $4.02.As the demand for tin increases to D1, how will the buffer-stock manager need to respond?

A) buy 10,000 pounds of tin

B) buy 20,000 pounds of tin

C) sell 10,000 pounds of tin

D) sell 20,000 pounds of tin

Correct Answer:

Verified

Correct Answer:

Verified

Q109: To help developing countries expand their industrial

Q110: East Asian economies have performed well by<br>A)

Q111: What are some of the growth strategies

Q112: East Asian economies started enacting export-push strategies<br>A)

Q113: In 1999 the United States revoked the

Q115: Once a cartel establishes its profit-maximizing price,<br>A)

Q116: Assuming identical cost and demand curves, OPEC

Q117: A multilateral contract stipulates the maximum price

Q118: To prevent the market price of tin

Q119: The recent technological advances in oil production,