Multiple Choice

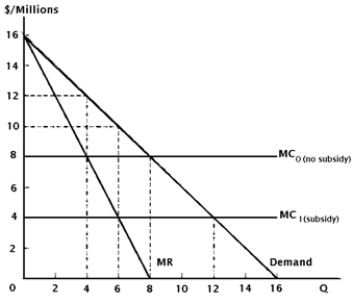

Assume Boeing Inc. (of the United States) and Airbus Industries (of Europe) rival for monopoly profits in the Canadian aircraft market. Suppose the two firms face identical cost and demand conditions, as seen in Figure 6.1.

Figure 6.1. Strategic Trade Policy: Boeing versus Airbus

-Consider Figure 6.1.Suppose the European government provides Airbus a subsidy of $4 million on each aircraft manufactured and that the subsidy convinces Boeing to exit the Canadian market.As the monopoly seller, Airbus maximizes profit by selling ______________ aircraft at a price of $______________, and realizes profits totaling $______________.

A) 6, $10 million, $36 million

B) 6, $12 million, $24 million

C) 12, $10 million, $36 million

D) 12, $12 million, $24 million

Correct Answer:

Verified

Correct Answer:

Verified

Q2: It is widely recognized that the economic

Q3: Throughout the post-World War II era, the

Q4: The high point of U.S.protectionism occurred with

Q5: The strategic trade policy hypothesis assumes that

Q6: The Uruguay Round of trade negotiations resulted

Q8: The World Trade Organization was established by

Q9: Intellectual property refers to holdings of rare

Q10: Under U.S.commercial policy, which clause permits the

Q11: The only members of the General Agreement

Q12: Normal trade relations (the most-favored-nation clause) tend