Multiple Choice

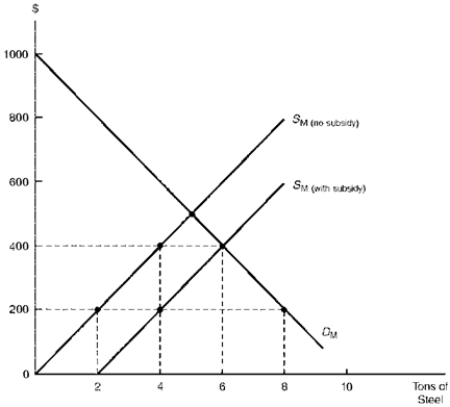

Figure 5.1 illustrates the steel market for Mexico, assumed to be a "small" country that is unable to affect the world price. Suppose the world price of steel is given and constant at $200 per ton. Now suppose the Mexican steel industry is able to obtain trade protection.

Figure 5.1. Alternative Nontariff Trade Barriers Levied by a "Small" Country

-Consider Figure 5.1.Suppose the rest of the world voluntarily agrees to reduce steel shipments to Mexico vis-a-vis an export quota equal to 2 tons.Assuming Mexican importers behave as monopoly buyers while foreign exporters behave as competitive sellers, the overall welfare loss of the quota to Mexico is

A) $200.

B) $400.

C) $600.

D) $800.

Correct Answer:

Verified

Correct Answer:

Verified

Q21: Excessive sea transport and freight regulations are

Q22: Figure 5.3. Sweden's Apple Market <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB7110/.jpg"

Q23: A global import quota permits a specified

Q24: Figure 5.3. Sweden's Apple Market <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB7110/.jpg"

Q25: Figure 5.3. Sweden's Apple Market <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB7110/.jpg"

Q27: Nontariff trade barriers include all of the

Q28: In recent years, the average antidumping duty

Q29: The sugar import quotas of the U.S.government

Q30: In certain industries, Japanese employers do not

Q31: Suppose the government grants a subsidy to