Essay

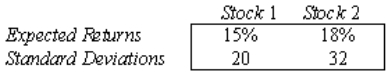

An analysis of the stock market produces the following information about the returns of two stocks:  Assume that the returns are positively correlated, with

Assume that the returns are positively correlated, with  12 = 0.80.

12 = 0.80.

a. Find the mean and standard deviation of the return on a portfolio consisting of an equal investment in each of the two stocks.

b. Suppose that you wish to invest $1 million. Discuss whether you should invest your money in stock 1, stock 2, or a portfolio composed of an equal amount of investments on both stocks.

Correct Answer:

Verified

a. The expected return on the portfolio ...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q14: The number of people winning a lottery

Q17: The P(X ≤ x) is an example

Q23: Let X be a binomial random variable

Q37: Which of the following best describes a

Q38: The expected value, E(X), of a

Q39: Let X represent the number of

Q41: If X and Y are two

Q43: The probability distribution for X ,daily

Q45: The weighted average of the possible values

Q46: The standard deviation of a binomial