Essay

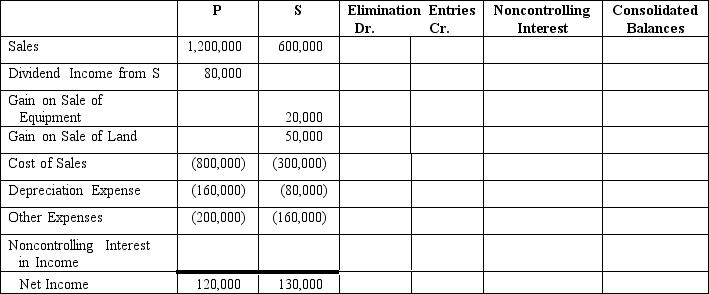

P Corporation acquired 80% of the outstanding voting stock of S Corporation when the fair values equaled the book values.

On July 1, 2013, P sold land to S for $300,000.The land originally cost P $200,000.S recently resold the land on October 30, 2014 for $350,000.

On October 1, 2014, S Corporation sold equipment to P Corporation for $80,000.S originally paid $100,000 for this equipment and had accumulated depreciation of $40,000 thus far.The equipment has a five-year remaining life.

Required:

A.Complete the consolidated income statement for P Corporation and subsidiary for the year ended December 31, 2014.

Correct Answer:

Verified

Correct Answer:

Verified

Q12: In years subsequent to the upstream intercompany

Q13: In years subsequent to the year a

Q19: Several years ago, P Company bought land

Q31: Define consolidated retained earnings using the analytical

Q33: Petunia Company owns 100% of Sage Corporation.On

Q34: On January 1, 2013, Pound Company acquired

Q36: P Company bought 60% of the

Q37: What is the essential procedural difference between

Q39: Pine Company, a computer manufacturer, owns 90%

Q40: Should stock options be expensed on the