Multiple Choice

Use the following information for Questions 22 & 23:

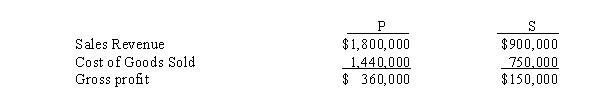

P Company regularly sells merchandise to its 80%-owned subsidiary, S Corporation.In 2013, P sold merchandise that cost $192,000 to S for $240,000.Half of this merchandise remained in S's December 31, 2013 inventory.During 2014, P sold merchandise that cost $300,000 to S for $375,000.Forty percent of this merchandise inventory remained in S's December 31, 2014 inventory.Selected income statement information for the two affiliates for the year 2014 is as follows:

-Consolidated cost of goods sold for P Company and Subsidiary for 2014 are:

A) $1,809,000.

B) $1,815,000.

C) $1,821,000.

D) $2,190,000.

Correct Answer:

Verified

Correct Answer:

Verified

Q1: Polly, Inc.owns 80% of Saffron, Inc.During 2014,

Q3: The following balances were taken from the

Q5: Does the elimination of the effects of

Q6: Poole Company owns a 90% interest in

Q7: P Corporation acquired a 60% interest in

Q8: On January 1, 2014, Pharma Company

Q9: What is the essential procedural difference between

Q10: What procedure is used in the consolidated

Q14: In determining controlling interest in consolidated income

Q24: Sales from one subsidiary to another are