Essay

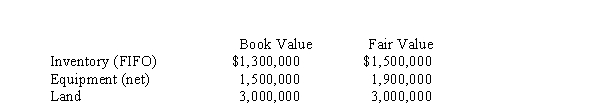

Pullman Corporation acquired a 90% interest in Sleeter Company for $6,500,000 on January 1 2013.At that time Sleeter Company had common stock of $4,500,000 and retained earnings of $1,800,000.The balance sheet information available for Sleeter Company on January 1, 2013, showed the following:

The equipment had a remaining useful life of ten years.Sleeter Company reported $240,000 of net income in 2013 and declared $60,000 of dividends during the year.

Required:

Prepare the workpaper entries assuming the cost method is used, to eliminate dividends, eliminate the investment account, and to allocate and depreciate the difference between implied and book value for 2013.

Correct Answer:

Verified

Correct Answer:

Verified

Q1: Pennington Corporation purchased 80% of the voting

Q2: Primer Company acquired an 80% interest in

Q2: Simple Company, a 70%-owned subsidiary of Punter

Q3: On January 1, 2013, Pilsner Company

Q5: On November 30, 2013, Piani Incorporated purchased

Q6: The excess of fair value over implied

Q9: Pruin Corporation acquired all of the voting

Q10: Sleepy Company, a 70%-owned subsidiary of Pickle

Q25: If the fair value of the subsidiary's

Q29: In preparing consolidated working papers, beginning retained