Essay

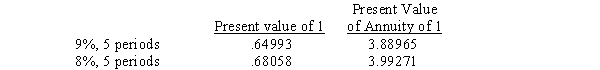

On January 1, 2013, Preston Corporation acquired an 80% interest in Spiegel Company for $2,400,000.At that time Spiegel Company had common stock of $1,800,000 and retained earnings of $800,000.The book values of Spiegel Company's assets and liabilities were equal to their fair values except for land and bonds payable.The land's fair value was $120,000 and its book value was $100,000.The outstanding bonds were issued on January 1, 2005, at 9% and mature on January 1, 2015.The bond principal is $600,000 and the current yield rate on similar bonds is 8%.

Required:

Prepare the workpaper entries necessary on December 31, 2013, to allocate, amortize, and depreciate the difference between implied and book value.

Correct Answer:

Verified

Correct Answer:

Verified

Q6: In a business combination accounted for as

Q11: Dividends declared by a subsidiary are eliminated

Q23: Goodwill represents the excess of the implied

Q27: Under which set of circumstances would it

Q28: The parent company's share of the fair

Q29: Use the following information to answer questions

Q31: Use the following information to answer questions

Q33: On January 1, 2013, Lester Company purchased

Q34: Use the following information to answer questions

Q36: When the implied value exceeds the aggregate