Essay

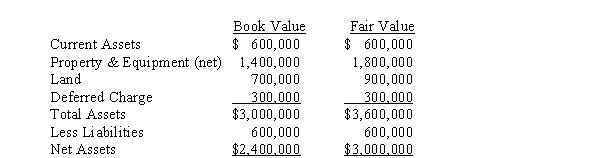

Plain Corporation acquired a 75% interest in Swampy Company on January 1, 2013, for $2,000,000.The book value and fair value of the assets and liabilities of Swampy Company on that date were as follows:

The property and equipment had a remaining life of 6 years on January 1, 2013, and the deferred charge was being amortized over a period of 5 years from that date.Common stock was $1,500,000 and retained earnings was $900,000 on January 1, 2013.Plain Company records its investment in Swampy Company using the cost method.

Required:

Prepare, in general journal form, the December 31, 2013, workpaper entries necessary to:

A.Eliminate the investment account.

B.Allocate and amortize the difference between implied and book value.

Correct Answer:

Verified

Correct Answer:

Verified

Q9: Under push down accounting, the workpaper entry

Q14: Pinta Company acquired an 80% interest in

Q15: Use the following information to answer questions

Q16: Use the following information to answer questions

Q18: What are the arguments for and against

Q20: How do you determine the amount of

Q21: Use the following information to answer questions

Q22: Pulman Company acquired 90% of the stock

Q23: Use the following information to answer questions

Q24: In what account is the difference between