Multiple Choice

Use the following information to answer questions

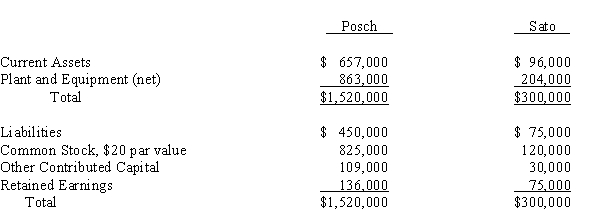

Posch Company issued 12,000 shares of its $20 par value common stock for the net assets of Sato Company in a business combination under which Sato Company will be merged into Posch Company.On the date of the combination, Posch Company common stock had a fair value of $30 per share.Balance sheets for Posch Company and Sato Company immediately prior to the combination were as follows:

-If the business combination is treated as an acquisition and the fair value of Sato Company's current assets is $135,000, its plant and equipment is $363,000, and its liabilities are $84,000, Posch Company's financial statements immediately after the combination will include

A) Negative goodwill of $54,000.

B) Plant and equipment of $1,226,000.

C) Plant and equipment of $1,172,000.

D) An extraordinary gain of $54,000.

Correct Answer:

Verified

Correct Answer:

Verified

Q11: Parental Company and Sub Company were combined

Q15: Under SFAS 141R:<br>A) both direct and indirect

Q16: In a leveraged buyout, the portion of

Q26: If the value implied by the purchase

Q27: Following its acquisition of the net

Q28: The first step in determining goodwill impairment

Q28: A business combination is accounted for properly

Q29: SFAS 141R requires that the acquirer disclose

Q34: Use the following information to answer questions

Q36: Condensed balance sheets for Rich Company