Short Answer

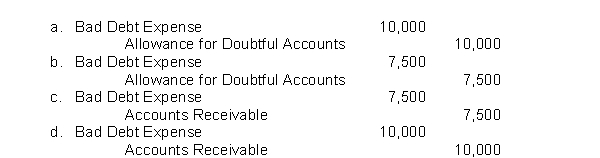

Nichols Company uses the percentage of receivables method for recording bad debts expense. The accounts receivable balance is $250,000 and credit sales are $1,000,000. Management estimates that 4% of accounts receivable will be uncollectible. What adjusting entry will Nichols Company make if the Allowance for Doubtful Accounts has a credit balance of $2,500 before adjustment?

Correct Answer:

Verified

Correct Answer:

Verified

Q7: If a retailer regularly sells its receivables

Q18: Which board(s) has(have) faced bitter opposition when

Q41: Allowance for Doubtful Accounts is a contra

Q75: Both the gross amount of receivables and

Q79: Which of the following is <b>least</b> likely

Q132: Receivables might be sold to<br>A) lengthen the

Q165: Barber Company lends Monroe Company $40,000

Q185: The accounts receivable turnover is used to

Q188: Net credit sales for the month are

Q236: Bad Debt Expense is considered<br>A) an avoidable