Short Answer

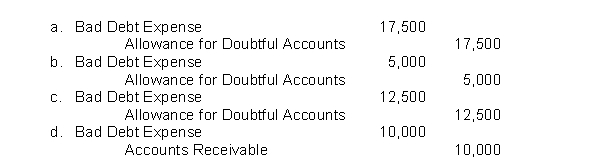

Kinsler Company uses the percentage-of-receivables method for recording bad debt expense. The Accounts Receivable balance is $250,000 and credit sales are $1,000,000. Management estimates that 6% of accounts receivable will be uncollectible. What adjusting entry will Kinsler Company make if the Allowance for Doubtful Accounts has a credit balance of $2,500 before adjustment?

Correct Answer:

Verified

Correct Answer:

Verified

Q1: The accounts receivable turnover is needed to

Q56: The interest on a $15,000, 6%, 60-day

Q93: The expense recognition principle relates to credit

Q137: Douglas Company has a $60,000 note that

Q164: Allowance for Doubtful Accounts is debited under

Q174: Using the allowance method, the uncollectible accounts

Q178: A company sells $800,000 of accounts receivable

Q181: Using the percentage-of-receivables method for recording bad

Q191: A company regularly sells its receivables to

Q195: An aging of a company's accounts receivable