Multiple Choice

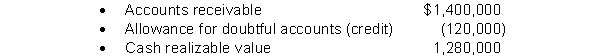

The following information is related to December 31, 2016 balances.  During 2017 sales on account were $390,000 and collections on account were $230,000. Also, during 2017 the company wrote off $22,000 in uncollectible accounts. An analysis of outstanding receivable accounts at year end indicated that bad debts should be estimated at $144,000. Bad debt expense for 2017 is:

During 2017 sales on account were $390,000 and collections on account were $230,000. Also, during 2017 the company wrote off $22,000 in uncollectible accounts. An analysis of outstanding receivable accounts at year end indicated that bad debts should be estimated at $144,000. Bad debt expense for 2017 is:

A) $46,000.

B) $24,000.

C) $144,000.

D) $ 2,000.

Correct Answer:

Verified

Correct Answer:

Verified

Q56: During 2017 Sedgewick Inc. had sales on

Q87: If bad debt losses are significant, the

Q90: IFRS<br>A)implies that receivables with different characteristics should

Q105: Advances to employees are referred to as

Q114: Under the direct write-off method, no attempt

Q134: A major advantage of national credit cards

Q140: When a company receives an interest-bearing note

Q156: A popular variation of the accounts receivable

Q183: Bad Debt Expense is reported on the

Q198: An aging of a company's accounts receivable