Essay

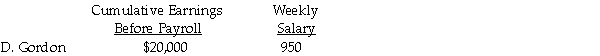

Sweetman's Recording Studio payroll records show the following information:

Assume the following:

a)FICA: OASDI,6.2% on a limit of $117,000;Medicare,1.45%.

b)Each employee contributes $40 per week for union dues.

c)State income tax is 5% of gross pay.

d)Federal income tax is 20% of gross pay.

Prepare a general journal payroll entry.

Correct Answer:

Verified

Correct Answer:

Verified

Q4: The correct journal entry to record the

Q20: Prepare the general journal entry to record

Q54: Ben's Mentoring had the following information for

Q71: What type of an account is Wages

Q90: Payroll information for Kinzer's Interior Decorating

Q93: A calendar quarter is made up of:<br>A)4

Q96: For each of the following, identify

Q99: The following data applies to the July

Q103: Prepare the general journal entry to record

Q103: Prepare the general journal entry to record