Essay

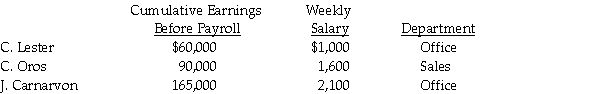

Prepare a general journal payroll entry for Advanced Computer Programming using the following information:

Assume the following:

a)FICA: OASDI,6.2% on a limit of $117,000;Medicare,1.45%.

b)Federal income tax is 15% of gross pay.

c)Each employee pays $20 per week for medical insurance.

Correct Answer:

Verified

Correct Answer:

Verified

Q57: Prepare the general journal entry to record

Q79: If Wages and Salaries Payable is debited,what

Q80: Using the information below,determine the amount

Q82: The payroll tax expense is recorded at

Q86: For each of the following, identify

Q87: Tax form 940 is filed annually.

Q89: The following data applies to the July

Q95: Businesses will make their payroll tax deposits

Q96: Why would a company use a separate

Q98: Why are the employee deductions recorded as