Essay

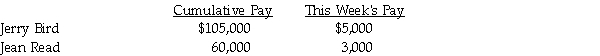

Compute the net pay for each employee listed below.Assume the following rates: FICA-OASDI 6.2% on a limit of $117,000;Medicare is 1.45%;federal income tax is 20%;state income tax is 5%;and union dues are $10.

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q4: The amount withheld for FICA is based

Q13: Which of the below allowances would have

Q97: Given the following payroll items you

Q99: An employee earns $30 per hour.<br>She worked

Q103: For each of the following, identify in

Q105: The amount of FICA-OASDI and FICA-Medicare withheld

Q106: Estimate the annual advance premium for workers'

Q107: An employee has gross earnings of $1000

Q126: Prepaid Workers' Compensation Insurance is what type

Q129: Premiums for workers' compensation insurance may be