Multiple Choice

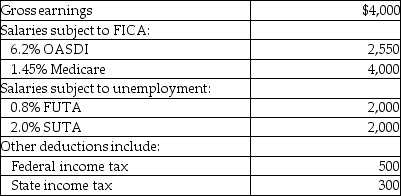

Bob's Auction House's payroll for April includes the following data:

What is the employer's portion of the taxes?

A) $1,072.10

B) $56.00

C) $272.10

D) $800.00

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q27: Employers pay the following payroll taxes,except:<br>A)FICA-OASDI.<br>B)Federal income

Q30: Both employees and employers pay which of

Q32: List the purposes of Federal Insurance Contributions

Q34: Companies can choose different pay periods for

Q35: Gene's Tax Service has two types of

Q59: The individual employee earnings record provides a

Q67: The CFC College Credit Card Services has

Q83: When calculating the employer's payroll tax expense,

Q124: To have less money withheld from your

Q135: A calendar quarter consists of:<br>A) 13 weeks.<br>B)