Multiple Choice

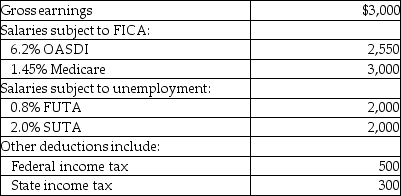

Bob's Auction House's payroll for April includes the following data:

What is the employee's portion of the taxes?

A) $1,057.60

B) $1,001.60

C) $257.60

D) $800.00

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q9: Given the following payroll items you

Q10: Given the following payroll items you

Q11: Dave Brown's cumulative earnings are $73,000,and his

Q15: There are two parts to FICA:<br>A)old age

Q16: Bill James earned $800 for the week.If

Q17: A work week is 180 hours in

Q63: FICA (OASDI and Medicare) and unemployment taxes

Q109: To examine in detail the weekly payroll

Q122: Workers' compensation:<br>A) insures employees against losses they

Q134: Gross Earnings are the same as:<br>A) regular