Multiple Choice

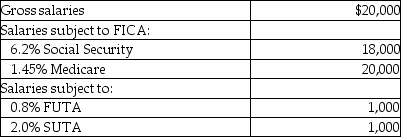

Bob's Cake House's payroll for April includes the following data:

The employer's payroll tax for the period would be:

A) $1,558.

B) $1,434.

C) $1,935.

D) $2,090.

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q23: Workers' compensation insurance is deducted from employees'

Q37: An employee has gross earnings of $1,200

Q38: Bob's Auction House's payroll for June includes

Q39: For each of the following, identify in

Q40: Todd earns an hourly rate of $20

Q42: Compute employee FICA taxes for the year

Q44: Under the Fair Labor Standards Act,for any

Q83: When calculating the employer's payroll tax expense,

Q92: The payroll taxes the employer is responsible

Q136: An employer can reduce the federal unemployment