Multiple Choice

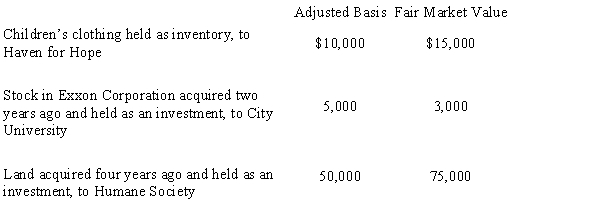

During the current year, Owl Corporation (a C corporation) , a retailer of children's apparel, made the following donations to qualified charitable organizations.  How much qualifies for the charitable contribution deduction (ignoring the taxable income limitation) ?

How much qualifies for the charitable contribution deduction (ignoring the taxable income limitation) ?

A) $63,000

B) $65,000

C) $90,500

D) $92,500

E) None of the above

Correct Answer:

Verified

Correct Answer:

Verified

Q7: Pink,Inc.,a calendar year C corporation,manufactures golf gloves.For

Q13: Employment taxes apply to all entity forms

Q20: Rajib is the sole shareholder of Robin

Q32: Grackle Corporation, a personal service corporation, had

Q51: Which of the following statements is incorrect

Q56: Dawn is the sole shareholder of Thrush

Q76: For a corporation,the domestic production activities deduction

Q80: What is the purpose of Schedule M-3?

Q94: Saleh, an accountant, is the sole shareholder

Q99: Briefly describe the charitable contribution deduction rules