Essay

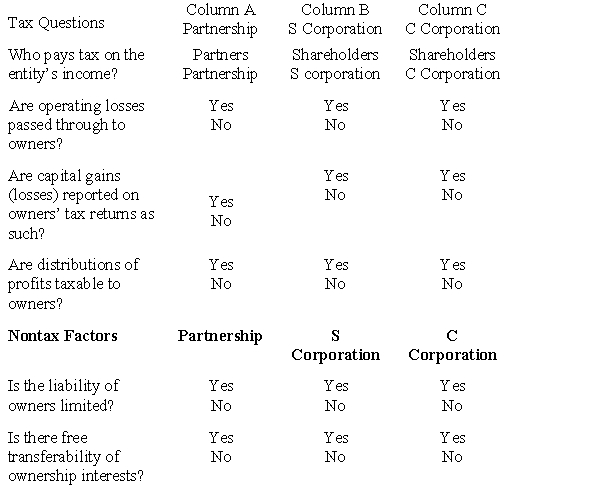

Compare the basic tax and nontax factors of doing business as a partnership, an S corporation, and a C corporation. Circle the correct answers.

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q7: Lilac Corporation incurred $4,700 of legal and

Q11: Thrush Corporation files Form 1120, which reports

Q20: Rajib is the sole shareholder of Robin

Q21: What is a limited liability company? What

Q51: Which of the following statements is incorrect

Q68: A corporation must file a Federal income

Q76: For a corporation,the domestic production activities deduction

Q78: On December 16, 2016, the directors of

Q79: Gerald, a cash basis taxpayer, owns 70%

Q99: Briefly describe the charitable contribution deduction rules