Essay

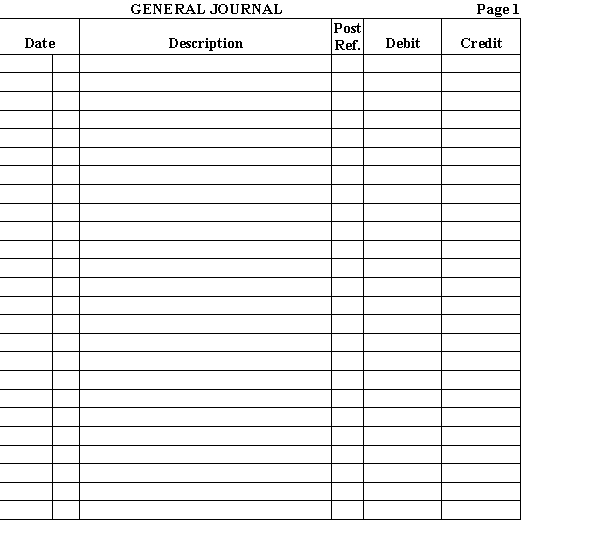

Prepare journal entries for the following transactions for Sanchez Co. using the general journal.

Feb. 28

Machinery that cost $57,000 and had accumulated depreciation of $46,000 was sold for $2,500.

Apr. 10

A van that cost $23,700 and had accumulated depreciation of $21,000 was sold for $1,250.

July 16

Equipment that cost $120,000 and had accumulated depreciation of $112,000 was traded in for new equipment with a fair market value of $140,000. The old equipment and $135,000 in cash were given for the new equipment.

Aug. 11

Equipment that cost $50,000 and had accumulated depreciation of $43,000 was traded in for new equipment with a fair market value of $62,000. The old equipment and $55,000 in cash were given for the new equipment.

Nov. 10

A truck that cost $44,000 and had accumulated depreciation of $38,000 was traded in for a new truck with a fair market value of $58,000. The old truck and $50,000 cash were given for the new truck.

Correct Answer:

Verified

Correct Answer:

Verified

Q4: Costs and assessments that should NOT be

Q5: If a plant asset has been fully

Q6: Match the terms with the definitions.<br>-The practice

Q7: Physical depreciation refers to the loss of

Q8: Use the following data: <span

Q10: Match the terms with the definitions.<br>-The sum

Q11: Match the terms with the definitions.<br>-Assets that

Q12: Match the terms with the definitions.<br>-A grant

Q13: The depreciation method in which the depreciable

Q14: The depreciation method that estimates the number