Essay

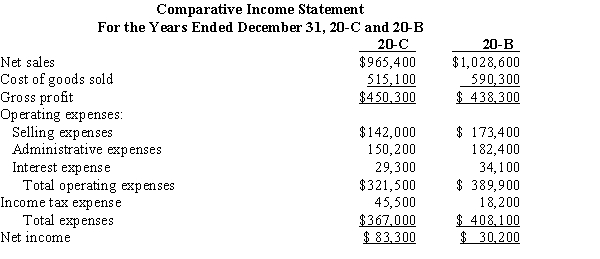

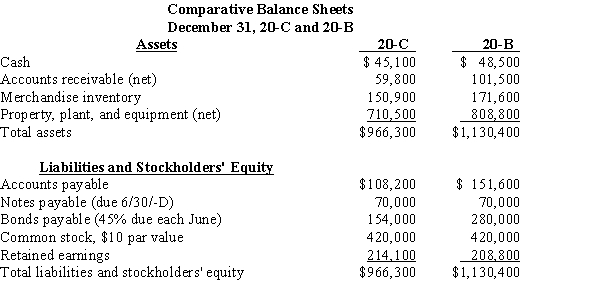

Use the following comparative income statements and balance sheets to complete the required ratio analysis.

Additional information:

Additional information:

All sales are made on account. Balances of selected accounts for December 31, 20-A are accounts receivable (net), $73,800; merchandise inventory, $153,100; total assets, $906,900; common stockholders' equity, $527,200; and common shares outstanding, 42,000.  Required:

Required:

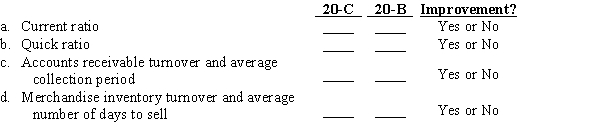

Prepare a liquidity analysis by calculating for 20-B and 20-C the (a) current ratio, (b) quick ratio, (c) accounts receivable turnover, and (d) merchandise inventory turnover. Indicate whether there has been an improvement or not from 20-B to 20-C. Round all answers to two decimal places.

Correct Answer:

Verified

Correct Answer:

Verified

Q33: Match the terms with the definitions.<br>-The ratio

Q34: Consider the following:<br> <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2259/.jpg" alt="Consider the

Q35: The accounts receivable turnover measures how promptly

Q36: Dividing cost of goods sold by the

Q37: The quick or acid-test ratio is calculated

Q39: Total liabilities divided by total stockholders' equity

Q40: Match the terms with the definitions.<br>-The excess

Q41: Match the terms with the definitions.<br>-The ratio

Q42: The cost of goods sold for a

Q43: Match the terms with the definitions.<br>-The ratio