Essay

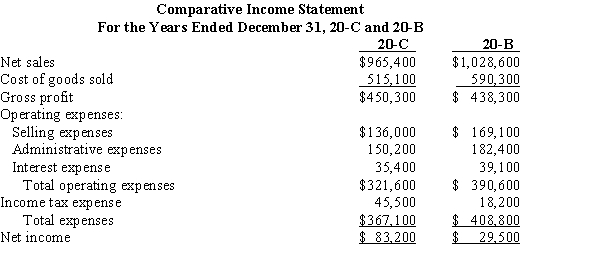

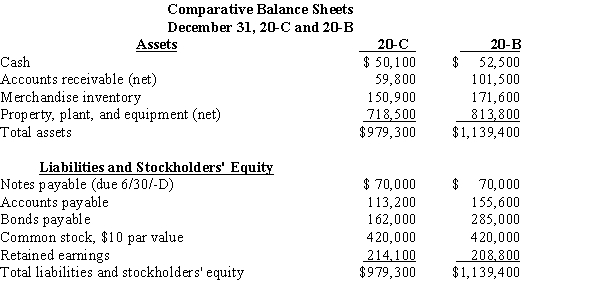

Use the following comparative income statements and balance sheets to complete the required ratio analysis:

Additional information:

Additional information:

All sales are made on account. Balances of selected accounts for December 31, 20-A are accounts receivable (net), $73,800; merchandise inventory, $139,200; total assets, $906,900; common stockholders' equity, $527,200; and common shares outstanding, 42,000.  Required:

Required:

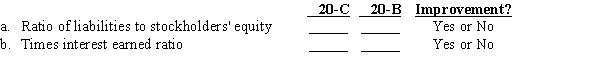

Analyze for 20-B and 20-C the extent to which this corporation is being financed by debt using the (a) ratio of liabilities to stockholders' equity, and analyze its ability to meet its debt obligation using the (b) times interest earned ratio. Indicate whether there has been an improvement or not from 20-B to 20-C. Round all answers to two decimal places.

Correct Answer:

Verified

Correct Answer:

Verified

Q41: Match the terms with the definitions.<br>-The ratio

Q42: The cost of goods sold for a

Q43: Match the terms with the definitions.<br>-The ratio

Q44: The return on total assets is calculated

Q45: Match the terms with the definitions.<br>-It is

Q47: Perform a vertical analysis of the following

Q48: Liquidity measures are intended to indicate an

Q49: A company has net sales on account

Q50: From the standpoint of the individual stockholder,

Q51: Vertical analysis reports the amount of each