Essay

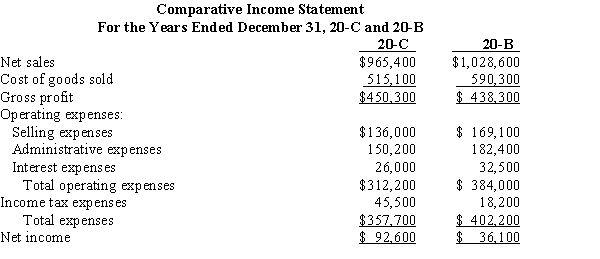

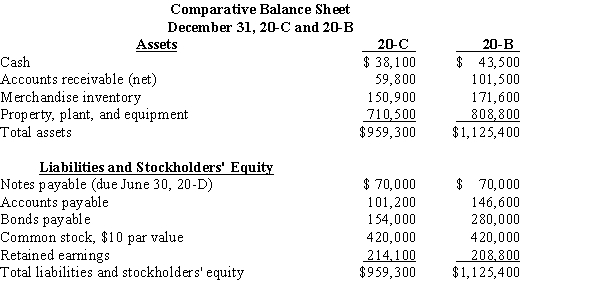

Use the comparative income statements and balance sheets below to complete the required ratio analysis.

Additional information:

Additional information:

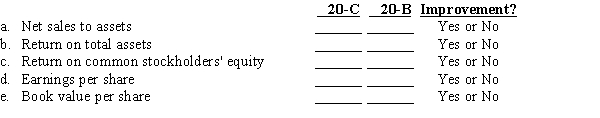

All sales are made on account. Balances of selected accounts for December 31, 20-A are accounts receivable (net), $73,800; merchandise inventory, $139,200; total assets, $906,900; common stockholders' equity, $527,200; and common shares outstanding 42,000. Prepare a profitability analysis by calculating for 20-B and 20-C the (a) net sales to assets, (b) return on total assets, (c) return on common stockholders' equity, (d) earnings per share, and (e) book value per share. Indicate whether there has been an improvement or not from 20-B to 20-C. Round to two decimal places.

Correct Answer:

Verified

Correct Answer:

Verified

Q24: A period of two consecutive years is

Q25: Match the terms with the definitions.<br>-A measure

Q26: If a corporation has only common stock

Q27: Consider the following: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2259/.jpg" alt="Consider the

Q28: Match the terms with the definitions.<br>-A comparison

Q30: The net income of a company for

Q31: A company has 6,000 shares of common

Q32: Match the terms with the definitions.<br>-The ratio

Q33: Match the terms with the definitions.<br>-The ratio

Q34: Consider the following:<br> <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2259/.jpg" alt="Consider the