Essay

Figure: Negative Externality

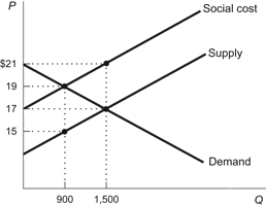

The figure shows the market for a good that causes a negative externality when consumed. The government decides to begin taxing its producers. Using the information provided in the figure, answer the following questions.

a. What is the market quantity in this market?

b. What is the social cost of the product?

c. When the product is taxed, what is the dollar amount of the deadweight loss that is removed from the market?

d. What is the new efficient quantity in this market after the tax has been imposed?

Correct Answer:

Verified

a. 1,500

b...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

b...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q22: Under the EPA's tradable allowances program, clean

Q41: Which answer suggests that private markets can

Q42: Tradable pollution permits:<br>A) have helped reduce sulfur

Q109: Why are taxes on pollutants and tradable

Q152: Fewer people get flu shots than is

Q166: In the case of an external cost,

Q175: When the number of tradable allowances is

Q181: If a market solution generates marginal social

Q219: When external benefits are significant:<br>A) market output

Q273: When external costs are present in a