Multiple Choice

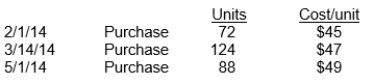

Lee Industries had the following inventory transactions occur during 2014:  The company sold 204 units at $63 each and has a tax rate of 30%. Assuming that a periodic inventory system is used, what is the company's gross profit using FIFO? (rounded to whole dollars)

The company sold 204 units at $63 each and has a tax rate of 30%. Assuming that a periodic inventory system is used, what is the company's gross profit using FIFO? (rounded to whole dollars)

A) $9,764

B) $9,460

C) $3,392

D) $3,088

Correct Answer:

Verified

Correct Answer:

Verified

Q40: The LIFO cost flow assumption can also

Q58: The factor which determines whether goods in

Q74: Henri Company uses the average-cost inventory method.

Q76: Clarke Company uses the periodic inventory method

Q95: Under the LCNRV approach, the net realizable

Q116: Overstating ending inventory will overstate all of

Q138: Instructions<br>Using the inventory and sales data above,

Q212: If a company has no beginning inventory

Q230: A problem with the specific identification method

Q257: Oakley Supply Company reports net income of