Multiple Choice

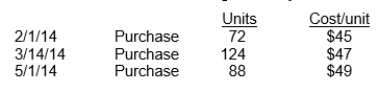

Lee Industries had the following inventory transactions occur during 2014:  The company sold 204 units at $63 each and has a tax rate of 30%. Assuming that a periodic inventory system is used, what is the company's after-tax income using FIFO? (rounded to whole dollars)

The company sold 204 units at $63 each and has a tax rate of 30%. Assuming that a periodic inventory system is used, what is the company's after-tax income using FIFO? (rounded to whole dollars)

A) $3,088

B) $3,392

C) $2,374

D) $2,160

Correct Answer:

Verified

Correct Answer:

Verified

Q5: Keiko Company took a physical inventory at

Q95: Brocken Co. has the following data related

Q97: The following information is available for Massey

Q99: Hoyt Company's inventory records show the following

Q103: Bellingham Inc. took a physical inventory at

Q105: Which inventory costing method most closely approximates

Q111: When valuing ending inventory under a perpetual

Q119: If the inventory reported on the statement

Q125: The consistent application of an inventory costing

Q156: If an error understates the beginning inventory,