Multiple Choice

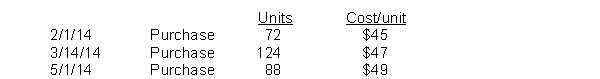

Lee Industries had the following inventory transactions occur during 2014:  The company sold 204 units at $63 each and has a tax rate of 30%. Assuming that a periodic inventory system is used, what is the company's gross profit using LIFO? (rounded to whole dollars)

The company sold 204 units at $63 each and has a tax rate of 30%. Assuming that a periodic inventory system is used, what is the company's gross profit using LIFO? (rounded to whole dollars)

A) $9,764

B) $9,460

C) $3,392

D) $3,088

Correct Answer:

Verified

Correct Answer:

Verified

Q22: The term "FOB" denotes<br>A) free on board.<br>B)

Q105: Which inventory costing method most closely approximates

Q107: At December 31, 2014, Bosan Corporation has

Q112: In a period of falling prices, the

Q112: Colletti Company recorded the following data: <img

Q114: Compute the lower-of-cost-or-net realizable value valuation for

Q115: Tatsoi Company's purchase and sales transactions for

Q145: Goods that have been purchased FOB destination

Q201: Tucker Department Store utilizes the retail inventory

Q235: The manager of Yates Company is given