Essay

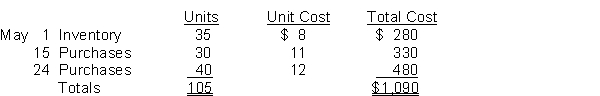

London Co. uses a periodic inventory system. Its records show the following for the month of May, in which 80 units were sold.

Instructions

Compute the ending inventory at May 31 and cost of goods sold using the (1) FIFO and (2) LIFO methods. Prove the amount allocated to cost of goods sold under each method.

Correct Answer:

Verified

Correct Answer:

Verified

Q45: The 2014 financial statements of Vitturo Company

Q64: An error that overstates the ending inventory

Q94: An auto manufacturer would classify vehicles in

Q138: The first-in first-out (FIFO) inventory method results

Q147: Accounting for inventories is important because inventories

Q208: Franco Company uses the FIFO inventory method.

Q210: A company just starting business made the

Q211: Kegin Company sells many products. Whamo is

Q215: For each of the independent events listed

Q218: The following information was available for Hoover