Short Answer

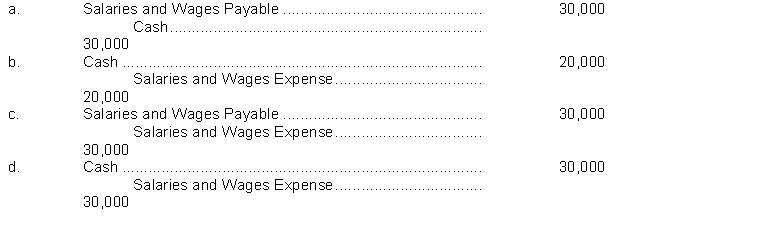

Farr Company paid the weekly payroll on January 2 by debiting Salaries and Wages Expense for $50,000. The accountant preparing the payroll entry overlooked the fact that Salaries and Wages Expense of $30,000 had been accrued at year end on December 31. The correcting entry is

Correct Answer:

Verified

Correct Answer:

Verified

Q25: The first item listed under current liabilities

Q51: Statement of financial position accounts are considered

Q111: Computing net income on the worksheet occurs

Q161: The purpose of the post-closing trial balance

Q191: If a company utilizes reversing entries they

Q212: When using a worksheet, adjusting entries are

Q257: At March 31, account balances after adjustments

Q258: The income statement for the month of

Q258: The four major classifications of assets in

Q261: These are selected account balances on December