Essay

Selected transactions for Sweet Home, a property management company, in its first month of business, are as follows.

Jan. 2 Issued ordinary shares to investors for $15,000 cash.

3 Purchased used car for $4,000 cash for use in business.

9 Purchased supplies on account for $500.

11 Billed customers $1,800 for services performed.

16 Paid $200 cash for advertising.

20 Received $700 cash from customers billed on January 11.

23 Paid creditor $300 cash on balance owed.

28 Paid dividends of $2,000.

Instructions

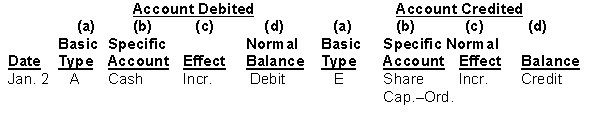

For each transaction indicate the following.

(a) The basic type of account debited and credited (asset (A), liability (L), equity (E)).

(b) The specific account debited and credited (cash, rent expense, service revenue, etc.).

(c) Whether the specific account is increased (incr.) or decreased (decr).

(d) The normal balance of the specific account.

Use the following format, in which the January 2 transaction is given as an example.

Correct Answer:

Verified

Correct Answer:

Verified

Q13: An awareness of the normal balances of

Q56: On July 7, 2014, Anaya Enterprises performed

Q57: A chart of accounts for a business

Q120: At December 1, 2014, Gibson Company's accounts

Q150: Transaction information may be entered directly into

Q158: An account consists of<br>A) one part.<br>B) two

Q171: Each transaction must be analyzed in terms

Q184: Your roommate, a marketing major, thinks that

Q188: Some of the following errors would cause

Q214: The bookkeeper for Dole Yard Service made