Essay

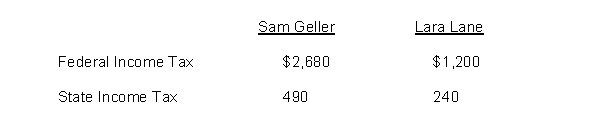

Sam Geller had earned (accumulated) salary of $99,000 through November 30. His December salary amounted to $9,000. Lara Lane began employment on December 1 and will be paid her first month's salary of $6,000 on December 31. Income tax withholding for December for each employee is as follows:  The following payroll tax rates are applicable:

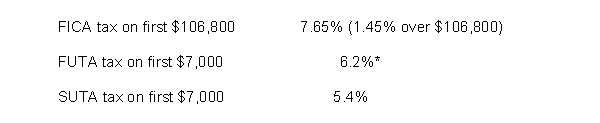

The following payroll tax rates are applicable:  *Less a credit equal to the state unemployment contribution

*Less a credit equal to the state unemployment contribution

Instructions

Record the payroll for the two employees at December 31 and record the employer's share of payroll tax expense for the December 31 payroll.

Correct Answer:

Verified

Correct Answer:

Verified

Q5: Amy Brown plans to buy a surround

Q19: FICA taxes and federal income taxes are

Q46: Which table has a factor of 1.00000

Q48: Match the items below by entering the

Q49: Gates Company maintains four special journals and

Q51: Listed below are various column headings that

Q58: A higher discount rate produces a higher

Q106: A payroll tax expense which is borne

Q131: An employer's estimated cost for post-retirement benefits

Q137: An advantage of using a subsidiary ledger