Essay

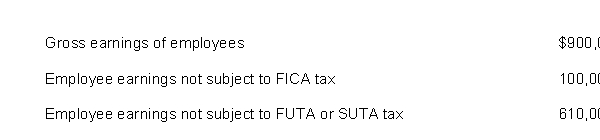

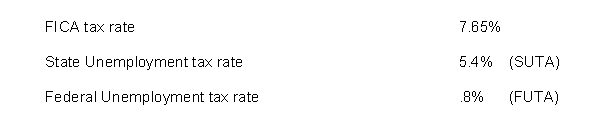

Banner Company had the following payroll data for the year:  Assume the following:

Assume the following:  Instructions

Instructions

Compute Banner's payroll tax expense for the year. Make a summary journal entry to record the payroll tax expense.

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q18: Martin Company issued $900000 10-year bonds and

Q38: Compound interest is the return on principal<br>A)

Q52: A subsidiary ledger frees the general ledger

Q54: Bill Cigarettes acquired a bad habit of

Q68: Diane Lane earns a salary of $9,500

Q71: Cecilia Jeffries purchased an investment for $49090.75.

Q124: If the single amount of $4,000 to

Q181: Match the statements below with the appropriate

Q231: Disclosure of a contingent liability is usually

Q251: Robin Clark has a cell phone that